Case Study

Distributed Ledger Technology Supporting Programmable Money

Development was completed on time, on budget, and on scope.

Current Challenge

Common Problems Faced by Enterprises

01

Global Banking

One of the leaders in global banking, with more than 70,000 employees, 400 branch offices, and 19 million customers, had a high-priority requirement for the development of enterprise-grade distributed applications to support a variety of monetary and other crypto asset transactions.

02

dApps

Without those distributed applications, “dApps”, the bank was having difficulty managing the complexities associated with cross-border money transfers.

03

Legacy

They were also relying on legacy, non-distributed, systems for the storage and exchange of data.

The Solution

Plasma’s Expertise

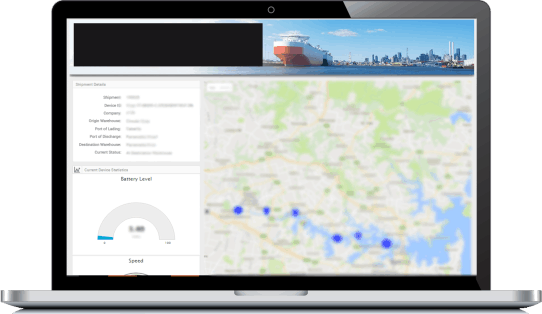

Distributed Ledger Technology (DLT) that supports all process and control requirements for the handling of programmable money.

Provision of synchronized digital data that can be disseminated across multiple financial institutions and geographic locations.

Full management and validation of complex cross-currency transactions.

Decentralized solution that dramatically reduces transaction times.

The Impact

Business/Operational Impact

Armed with its new DLT capabilities the client has been able to introduce new business capabilities that have provided distinct competitive advantages. This has included:

The ability to transfer funds at a fraction of the cost and time of traditional banking and full automation of handling of cross-currency transactions that promotes client confidence.

The client is able to bring much-needed stability and regulation into the realm of digital currency and crypto assets.

The client is now positioned to provide industry-disrupting business and operational capabilities well into the future.